Credit unions have seen quite a bit of membership growth over the last year – much of it due to the consumers’ disdain over the poor reputation commercial banks have earned lately.

Credit unions, to their credit, have profited from this “consumer windfall” and are now showing many of these new members how beneficial they really are by providing great service, equal if not better technology products, and much better rates (of course).

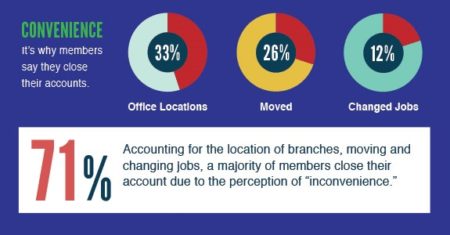

The one area most credit unions cannot compete, however, is the vast number of branch locations banks offer nationwide – and that’s a big issue when big banks seem to have branches planted virtually on every corner. Without this Starbucks-like coverage, how can credit unions retain its latest wave of new members who still demand traditional in-branch services?

With brick and mortar branches supposedly on their death knell, one could question: Who cares about branch coverage when you have online and mobile dominating the financial services landscape? That may be true in today’s headlines, but reality shows that branches remain a viable mainstay of business and image growth.

Members still want a handy branch nearby – nearly as much as they do their online platform or mobile phone. This is where credit union member retention kicks into gear.

Following Members When They Move:

Midwest Carpenters & Millwrights Federal Credit Union

Midwest Carpenters & Millwrights Federal Credit Union ($100 million; 21,650 members, Hobart, IN) serves more than 21,000 members residing in 15 states with just 23 employees working in its original location (they’ve been in Hobart more than 50 years).

Midwest Carpenters serves its growing membership across multiple states with only 23 employees via its shared branch network, which provides the infrastructure needed to accommodate its growth – without the costly expense of building and maintaining its own branches and adding scores of employees to its payroll.

Midwest Carpenters, like many credit unions today, has plenty of members who travel or have moved to where new work can be found. As a result, those craftsmen, retirees, and children of members who move away or leave for college have the ability to maintain their account. They also experience convenient service with the credit union almost anywhere.

Shared branching allows Midwest Carpenters to provide face-to-face convenient services, allowing its members to walk into 5,000 credit union buildings just by having their account with them. Members don’t need to join another financial institution for expanded branch coverage – shared branching has them covered.

To learn more, contact Chuck Barr today:

(317) 594-5303 or chuckb@servicecorp.com