Credit unions have seen quite a bit of membership growth over the last year – much of it due to the consumers’ disdain over the poor reputation commercial banks have earned lately. Credit unions, to their credit, have profited from this “consumer windfall” and are now showing many of these new found members how beneficial they really are by providing equal if not better service, equal if not better technology products, and much better rates (of course). The one area most credit unions cannot compete, however, is the vast number of branch locations banks host nationwide – and that’s a big issue with many new members used to big banks branches planted virtually on every corner. Without this Starbucks-like coverage, how can credit unions retain its latest wave of new members who still demand traditional in-branch services?

With brick and mortar branches supposedly on their death knell, one could question: Who cares about branch coverage when you have online and mobile dominating the financial services landscape? That may be true in today’s headlines, but reality shows that branches remain a viable mainstay of business and image growth. Consumers still crave the branch nearly as much as they do their online platform or mobile phone. So the need is there to provide branch services to the masses that continue to rely and enjoy venturing to an actual building and seek face-to-face service. This is where credit union member retention kicks into gear.

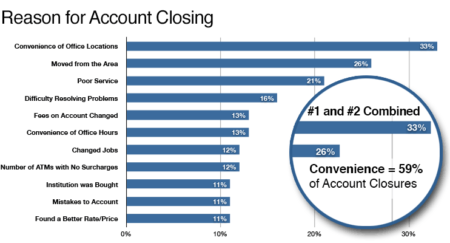

Consumer survey reveals that the primary reasons consumer’s close their account is based on convenience factors. (See chart below).

Branches are here to stay for the time being – just not as many of them as the numbers are decreasing. Yes, they are expensive to build, maintain, and staff, but there’s a handy cooperative service that only credit unions have in the financial services world that is one of the keys to retaining members who like visiting their branch. It’s a unique practice called shared branching. Shared branching provides a massive opportunity for credit unions to retain their members by cost-effectively expanding their footprint (a.k.a. branch coverage) without the added cost of building, maintaining, or staffing a brick and mortar locale. Using another credit union’s branches – along with an entire branch network of thousands of locations nationwide – is simply a smarter way to do business, which will ultimately help attract new members but also keep the ones they already have.

In today’s economy, Credit Unions are recognizing the importance of preserving member and account relationships as a key growth strategy and are relying on the large distribution channel of national branch access to serve and retain these members. Leveraging shared branching as an effective member retention strategy has become a key component for two credit unions.

Midwest Carpenters & Millwrights Federal Credit Union

For example, Midwest Carpenters & Millwrights Federal Credit Union ($100 million; 21,000 members, Hobart, IN) serves more than 21,000 members residing in 15 states with just a mere 23 employees working in its original location (they’ve been in Hobart more than 50 years). Midwest Carpenters serves its growing membership across multiple states with only 23 employees via its shared branch network, which provides the infrastructure needed to accommodate its growth – without the costly expense of building and maintaining its own branches and adding scores of employees to its payroll.

Midwest Carpenters, like many credit unions today, has plenty of members who constantly travel or live wherever their work is. As a result, those craftsmen, retirees, and children of members who move away or go away for college have the ability to maintain their account and experience convenient service with the credit union almost anywhere. Shared branching allows Midwest Carpenters to provide face-to-face convenient services, allowing its members to walk into 5,000 credit union buildings just by having their account with them. Members don’t need to join another financial institution for expanded branch coverage because shared branching already fulfills that requirement.

Purdue Federal Credit Union

Since incorporating shared branching into its service offering, it has become a way for Purdue Federal Credit Union ($1.17 billion; 76,705 members; West Lafayette, IN) to successfully retain members who find it easy and convenient to manage their accounts with the credit union by using shared branches – no matter where they reside nationwide. Based on the continually increasing numbers of transactions the credit union experiences through this service channel, it clearly provides a needed service for its members.

Some of these performance numbers include: Members of the credit union deposited more than $34.9 million into their accounts at the credit union in the last 12 months. Ordinarily, this is a number that wouldn’t normally raise eyebrows, but more than 2,450 different branches from 884 credit unions across 49 states were used to make these deposits along with other member transaction activity. Shared branching was definitely leveraged.

Not only does shared branching make sense to increase member retention among its student members, but the credit union also felt it would benefit the entire industry as a means of competing with large financial institutions through its nationwide branch services. The shared branching network has helped Purdue improve its member retention by more than 25%, as the credit union continues to promote shared branching very heavily to its students aiming to retain them as future members when they enter their prime earning years.

Purdue’s member retention specialists also leverage the shared branching message while conducting outbound calling programs to “at risk” members who the credit union believes it may lose based on their decreased account activity. This outbound calling program identifies “at risk” accounts, which allow them to share the information related about shared branching. Through these efforts, the credit union has discovered that its membership between the ages of 18 and 54 are the shared branch users – equating to 6.5 percent of Purdue’s 76,000-membership using shared branching.

With these two examples, two of many by the way, branches remain a standard for member service with shared branching leveraging that mainstay. This service, unique to the credit union industry, allows them to compete with the larger financial institutions providing comparable brick and mortar accessibility. As a result of this access, coupled with the tidal wave of online and mobile solutions currently flooding the industry, members are more inclined to stay with a credit union. But there’s one caveat: Credit unions need to enhance their messaging about the benefits of this still largely unknown shared branching service (to consumers) so there never is a second thought of switching to another FI for lack of convenient branch locations. The coverage is there; credit unions simply need to educate the influx of new members along with the established members in order to retain them for continued growth and success.